Automotive News – Cruise casts shadow on self-driving tech at CES 2024

See full original article by Pete Bigelow at Automotive News.

Cruise-related headwinds dampened the autonomous outlook in some quarters, but trucks may keep on rolling.

LAS VEGAS — Self-driving vehicles and advances in automated-driving technology have been a CES staple since Audi drove an A7 autonomously from San Francisco to Las Vegas nine years ago.

Not this time.

The turmoil at General Motors robotaxi subsidiary Cruise cast a long shadow across CES and dampened the outlook for self-driving technology.

“What’s unfortunate is the way this incident was handled undermined confidence in the industry, and that is creating a headwind that was avoidable,” said Augustin Wegscheider, managing director at BCG and co-leader of the consulting firm’s Center for Mobility Innovation.

California regulators said Cruise misrepresented the circumstances of an Oct. 2 robotaxi crash with a pedestrian in San Francisco. Cruise omitted information that revealed the robotaxi dragged the pedestrian 20 additional feet following the initial strike, officials said. They subsequently suspended the two permits needed for driverless operations in the state.

To be sure, there was a smattering of self-driving news, but it came from long-haul trucking companies rather than consumer-focused robotaxis and luxury cars. Kodiak Robotics and Aurora Innovation exhibited at CES, and both expect to launch a driverless commercial trucking service in Texas by the end of this year. But robotaxis took a back seat.

But Cruise competitors Motional and Zoox both test robotaxis in Las Vegas and anticipate offering commercial service in the city. CES could have been a breakout moment. Instead, they held a minimal presence.

“Everybody is laying low and probably intentionally so,” Wegscheider said.

With the lack of real-world demonstrations, industry executives and analysts spent CES lamenting the undercurrent of Cruise-related fallout permeating their discussions. They said much of 2024 would be spent digesting lessons learned from Cruise and helping the industry rebuild trust with regulators and consumers.

Those include emphasizing the importance of community engagement and outreach to public officials and regulators, said Selika Josiah Talbott, a mobility strategist and founder of Autonomous Vehicles Consulting.

“Cruise is almost like this knife in the heart,” she said. “Where they failed the most, I’m not going to say it’s even in safety. Where they failed was not understanding that human aspect.”

More investments required

Safety, outreach and technical concerns come on top of questions about the basic robotaxi business model, and a report issued in advance of CES from consulting firm McKinsey & Co. said AVs will require investment increases of 30 to 100 percent from current levels to reach fully automated deployments.

“We still do not have a good line of sight on that,” said Anshuman Saxena, vice president and head of automated driving products at Qualcomm, which has focused on developing advanced driver-assist products for the near term.

Developing autonomous-driving systems overall and robotaxis in particular have taken more capital than the industry anticipated when many believed widespread deployments were a near-term reality. The McKinsey & Co. report said “increased investments in software are needed to achieve full autonomy.” Estimates from an accompanying industry survey indicated the robotaxi business will require at least another $5 billion of investment.

This comes at a time when self-driving technology companies have cut back and endured layoffs. Cruise lost more than $700 million in the third quarter and $8 billion since 2016. Ford and Volkswagen gave up on their self-driving subsidiary Argo AI, shuttering it in October 2022.

There’s growing political opposition in some corners. Only a veto of legislation by Gov. Gavin Newsom prevented California from banning self-driving trucks without safety drivers. The International Brotherhood of Teamsters is pushing similar legislation in New York.

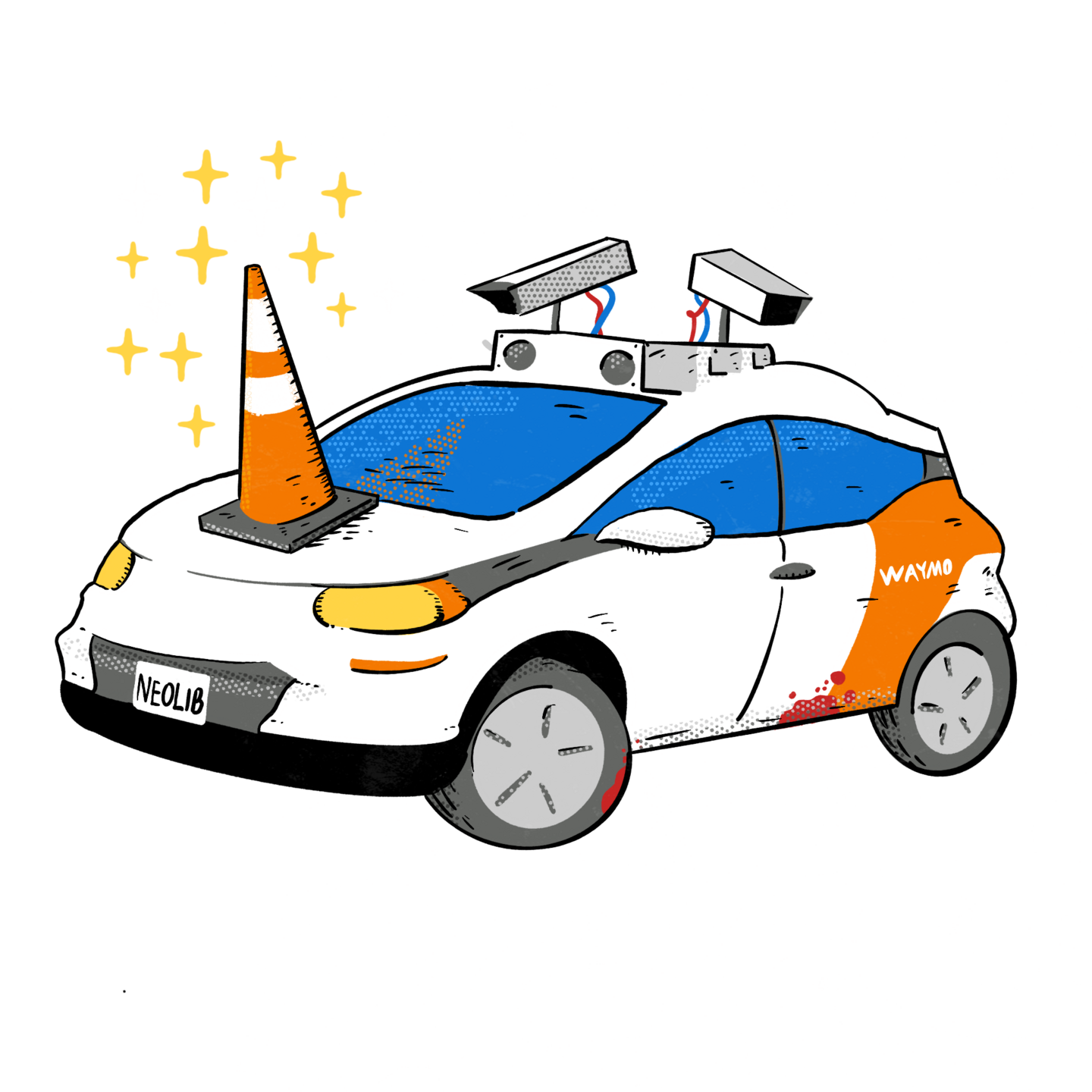

But if the self-driving promise is elusive, it remains tempting. Assisted driving and self-driving tech could create $300 billion to $400 billion in auto industry revenue by 2035, according to a separate McKinsey study issued in 2023. If the industry has slowed, the work continues at a steady pace. Robotaxi provider Waymo has operated driverless robotaxis in Phoenix for five years and began commercial operations in San Francisco in August.

Even with Cruise sparking concerns on the robotaxi front, the CES presence of Kodiak Robotics and Aurora Innovation brought confidence and momentum on the trucking front.

The two trucking companies showcased some of their preparations for the driverless operations expected by the end of 2024, which included finalizing of redundant hardware and fallback systems.

“It’s been a long journey, and there have been a lot of ups and downs,” said Kodiak Robotics CEO Don Burnette. Yet he said, “this is going to be the year of driverless, and it’s been a long time coming.”

See full original article by Pete Bigelow at Automotive News