Tesla: Disastrous management, $56B goes Poof, and a Heavy Metal Drummer Rocks On

Are we really supposed to take Full Self Driving seriously when Tesla’s sole purpose appears to be for enriching Elon Musk?

Editors note: the writing of this article was motivated by the amazing in depth Wall Street Journal article from 2/3/2024 titled The Money and Drugs That Tie Elon Musk to Some Tesla Directors. It really is worth the cost of a subscription.

Editors note: And I know you just want to know more about the heavy metal drummer and see the awesome video. Well, you have to scroll all the way to the bottom for that. Or hey, just read how this all went down. Its a pretty amazing story.

The Board is Broken (intentionally!)

A Board of Directors is obligated to maintain fiduciary responsibility. It is supposed to be all about maintaining optimal returns for the stockholders. But somehow the Board of Tesla has different motivations, and it all boils down to money. In veritable kick-back scheme, Musk found that if he compensated his board members by ridiculous amounts, then most of them would do anything to stay on the board and keep the money rolling in.

Multiple other directors of Musk companies have deep personal and financial ties to the billionaire entrepreneur, and have profited enormously from the relationship. The connections are an extreme blurring of friendship and fortune and raise questions among some shareholders about the independence of the board members charged with overseeing the chief executive. Such conflicts could run afoul of the loose rules governing what qualifies as independence at publicly traded companies.

…

The amount Tesla pays its directors is far more than the average compensation for boards at most U.S. companies. The average total compensation for board members in the largest 200 U.S. companies was $329,351 in 2023, according to a new report from the National Association of Corporate Directors and compensation consultant Pearl Meyer. By comparison, current Alphabet board members hold stock valued at about $8 million, and received an average annual compensation for board service of about $475,000 since 2015.

WSJ 2/3/2024

Probably helpful to see a chart to better understand the hundreds of millions of dollars in board compensation that has been sloshing around over the years:

Don’t Forget the Drugs!

The Wall Street Journal published an article on Feb. 3, 2024 titled The Money and Drugs That Tie Elon Musk to Some Tesla Directors. As you can imagine, the article is rather epic.

The Wall Street Journal reported in January that Musk has used drugs including cocaine, ecstasy, LSD and magic mushrooms, and that leaders at Tesla and SpaceX were concerned about it, particularly his recreational use of ketamine, for which Musk has said he has a prescription. The illegal drugs violate strict antidrug policies at Musk’s companies and could put SpaceX’s federal contracts and Musk’s security clearance at risk.

At the upscale Austin Proper Hotel, Musk has attended social gatherings in recent years with Tesla board member Joe Gebbia, the Airbnb co-founder and a friend of his, where Musk took ketamine recreationally through a nasal spray bottle multiple times, according to people familiar with the drug use and the parties.

Other directors, Gracias, Jurvetson and Kimbal Musk, have consumed drugs with him, according to people who have witnessed the drug use and others with knowledge of it.

Musk and some people close to him, including Kimbal Musk, attend parties at Hotel El Ganzo, a boutique hotel in San José del Cabo, Mexico, known for its art and music scene as well as drug-fueled events, according to people familiar with the parties.

WSJ – 2/3/2024

It wasn’t just money that made the Board beholden to Musk. it was also the drug fueled antics. Many were in no way independent directors, but instead close friends with a penchant to get high with their buddy.

The next issue is how Musk was going to use his control over the Board members to his financial advantage.

Foreshadowing: The SolarCity Debacle & Lawsuit

Once upon a time, in 2004, road tripping to Burning Man, Elon Musk convinced his cousins, Lyndon and Peter Rive that they should start a solar company. It was founded in 2006, and then was floundering in 2016 with billions in debt. Oops. Time for a bailout, paid for by someone else, the Tesla stockholders.

The suit claimed SolarCity “consistently failed to turn a profit, had mounting debt, and was burning through cash at an unsustainable rate.” It said SolarCity was $3 billion in debt at the time of the acquisition.

Business Insider – July 7, 2021

SolarCity had borrowed $165m from SpaceX, putting the rocket company as well at great financial risk. And Musk was chairman of SolarCity and owned 22% of the company. Musk had quite a bit of motivation.

SolarCity’s problems didn’t just matter to Musk because he was a shareholder and a board member of SolarCity, it mattered because the company’s fate was tied to SpaceX, a piece of his empire, according to the lawsuit.

SpaceX, Musk’s rocket company, had given SolarCity $165 million at the beginning of 2015, according to internal SolarCity emails filed as part of the lawsuit, and it was holding 77% of SolarCity’s bonds. In short, if SolarCity went down, it could take SpaceX with it.

Business Insider – Oct 30, 2019

In fact, many Tesla board members were seriously financially motivated to bail out SolarCity. Sure, the board was supposed to do what was best for Tesla, but money talks, and hundreds of millions of dollars screams real loud to the individuals on the Board.

Five Tesla board members had a clear financial interest in getting this deal past the finish line, the lawsuit alleged. They not only stood to lose a lot if SolarCity went under, but they also had a lot to gain if it were saved at a premium (as it was), the suit alleged.

Business Insider – Oct 30, 2019

In 2015 and 2016, Kimbal Musk used his SolarCity shares as collateral on his personal loans, according to his deposition. If SolarCity had gone bust, this would be a problem for him. But he testified that his personal loans had nothing to do with his support for the deal to have Tesla acquire SolarCity.

Business Insider – Oct 30, 2019

So what to do?? Well, how about some self-serving financial flimflammery!

In 2016, the empire that Elon Musk built to conquer earth and space was in peril, but Musk stepped in with a potentially illegal plot to save it all and stick Tesla shareholders with the bill, shareholders said in a lawsuit filed against Tesla.

Business Insider – Oct 30, 2019

Having Tesla buy SolarCity was of course financially a ridiculous idea, well, for everyone except for Musk and the other Tesla board members.

None of SolarCity’s problems had anything to do with Tesla shareholders, though. Aside from Musk, his brother Kimbal, and a few members of the board of directors who owned SolarCity stock, Tesla shareholders had to worry only about making cars. That’s why inside of Tesla, the board of directors and the C-suite knew it could be an uphill battle to get shareholders to approve the deal.

Business Insider – Oct 30, 2019

No other company was bidding to buy SolarCity, and according to internal emails, it was also struggling to find financing for a $200 million bridge loan that it needed immediately.

Business Insider – Oct 30, 2019

Therefore needed a solid looking excuse for Tesla to make the plunge, like an exciting new product!!! Not necessarily something that actually exists. Just some flash, an excuse, something newsworthy. But again, it could be about as practical as the Hyperloop, or maybe Full Self Driving.

So Musk gave them and other doubtful shareholders a reason to get on board.

In October 2016, Musk hosted a massive show on a Hollywood TV set, unveiling a product that didn’t yet exist — Tesla’s solar-roof tile.

…

After seeing the solar tile, Tesla shareholders approved the deal in November 2016.

Business Insider – Oct 30, 2019

According to multiple depositions, the solar-roof tile that Elon Musk presented in order to wow Tesla’s shareholders wasn’t actually a working product when it was unveiled.

Business Insider – Oct 30, 2019

In his deposition, Toby Corey, SolarCity’s president of global sales, said the roof Tesla unveiled in its presentation was not connected to a grid of any kind while it was being presented. He also said he couldn’t remember if Tesla ever sold a roof either.

“I don’t recall selling any,” he said, though he added he recalled that some roof tiles were being installed after the presentation.

Business Insider – Oct 30, 2019

Because enough of the Tesla board members would profit, the deal to acquire SolarCity was done in 2016. Musk in particular benefited by hundreds of millions of dollars, and then SolarCity crawled along in a slow and painful death march, losing almost all value, and shafting the general Tesla stockholders.

A lawsuit was filed against the Board of Tesla in 2017. All the Board members besides Musk settled for $60 million in January 2020, which was paid for by an insurance policy. That means the $60M settlement was actually paid for by the general stock holders who were suing in the first place. Hows that for some board of directors fiduciary responsibility!!

But some pension funds thought that the settlement was inadequate so continued with a lawsuit against Musk for $2B. In April 2022 Musk won the lawsuit with a 132-page judgement. The judge stated that Musk was “more involved in the process than a conflicted fiduciary should be” and the board’s process was “far from perfect,” but that Tesla paid a fair price for SolarCity. Musk got to keep the $2B, teaching him a good lesson on: control the board, go big, and hire excellent lawyers. Though this was a lesson that eventually wouldn’t work in his favor.

The $56B Payday

Hey, gimme a raise!

Now that Musk had firmly established that he completely controlled the board, and that he should always go big, it was time to ask his buddies for a raise. A big raise!! And in 2018 the board agreed to give him the biggest potential pay ever given to a US executive, ever!

Board members had signed off on the pay deal in 2018, with Tesla valuing it at a maximum of $55.8 billion. It was the biggest pay package ever to the chief executive of a U.S. public company, according to governance-data firm Equilar.

While negotiating the pay package, Musk emailed the company’s top lawyer explaining how he would use the additional compensation. “The added comp is just so that I can put as much as possible towards minimizing existential risk by putting the money towards Mars,” Musk wrote. Ehrenpreis, a yearslong friend [and recipient of several hundred million dollars from being on the Board], was head of the board’s compensation committee.

Company directors frequently allowed Musk an unusual amount of leeway on issues big and small.

WSJ – 2/3/2024

And how could the board have possibly refused? After all, being on good terms with Musk, to the point of doing lots of fun drugs with him, meant that they would continue to profit handsomely via excessive board compensation. And they have great lawyers. Everyone wins, well, except for those pesky peon stockholders who never had a chance to get tweaked with Musk…

Didn’t the Performance Targets Ensure Pay Would be Commensurate?

Some have argued that the pay package was reasonable since Tesla stockholders have benefited a large amount over the years. But this misses a few key points:

- Musk, being CEO, had insider information and knew that stock in 2018 undervalued and would likely increase significantly

- Musk was largest shareholder and already fully motivated due to existing stock

- It was for far more compensation then ever given a CEO

- The performance targets were cooked!

Excessive compensation for a CEO

How excessively high was Musk’s compensation? Well, the judge for the trial (there was no jury) had some choice words:

The incredible size of the biggest compensation plan ever – an unfathomable sum – seems to have been calibrated to help Musk achieve what he believed would make ‘a good future for humanity’

Judge McCormick in her 201-page opinion

In comparison to other CEOs Musk’s pay package was simply absurd.

Amit Batish at Equilar, an executive pay research firm, estimated in 2022 that Musk’s package was around six times larger than the combined pay of the 200 highest-paid executives in 2021.

MSN – Judge voids Elon Musk’s ‘unfathomable’ $56 billion Tesla pay package

But what about Musk’s complaints about the compensation for the Lucid CEO Peter Rawlinson, the highest paid CEO of all US automakers in 2022?? Yes, he did make $379M in 2022, while the stock of Lucid plummeted by 85%. But Rawlinson was rewarded for achieving market-value milestones, as Musk was. The problem wasn’t lack of meeting milestones. The problem was that the milestones were very poorly chosen by the Board of Directors, as they were with Musk’s pay package.

And it should be remembered that Lucid was funded via a SPAC, which are financial house-of-cards Ponzi schemes that exist solely to float financially questionable companies until the initial funders can profit and exit. SPACs often pay CEOs an absurd amount of money, even as the stock craters, because that is just how they roll. And Lucid is now delisted from NASDAQ because of poor management. One has to question the entire financial premise of Lucid, not just the compensation of their CEO.

Cooked performance targets: EBITA

If the only performance target was stock price then it would have obviously been easy for Musk to continue his usual habits and say most anything to pump up the price, as in “funding secured” to take the company private (hah!), which of course spawned a whole other lawsuit. To make the pay package look more solid, revenue/profitability targets were naturally added. But the CFO of Tesla found a great way to define “profit” to suit Musk’s needs, and this meant that revenue was not actually relevant.

Instead of determining profitability using Generally Accepted Accounting Principles (GAAP), they used the very suspect EBITA (Earnings Before Interest, Taxes, Depreciation, and Amortization). According to Warren Buffett, EBITA is not reflective of a company’s true financial performance due to neglecting capital expenditures (Capex) and changes in working capital. And this is especially true for large manufacturers since their large factories are very capital intensive.

Does management think the tooth fairy pays for capital expenditures?

Warren Buffett

Let’s see what this tax-paying, debt-ridden, asset-heavy company looks like without any debt, without tax burden, without assets and with no working capital needs!

Ted Gavin – Forbes

For more in depth information on why EBITA not appropriate for Musk’s pay package see “Elon’s Tesla compensation package: Too much, too little, or just right?”

Plus EBITA is subjective. Items can be added or subtracted based on the needs of the CEO.

And if you want even more info on the problems of EBITA, Moody’s Investors Services released a report titled “Ten Critical Failings of EBITDA as the Principal Determinant of Cash Flow” (free registration required).

Cooked performance targets: effects of temporary regulatory credits

And besides EBITA not being an appropriate metric, there is also the issue of temporary regulatory credits making up a key part of Tesla income.

Basically, automakers in the U.S., Europe, China, etc. are awarded regulatory credits for selling zero-emission vehicles (ZEVs), and automakers are required to reach a certain amount of regulatory credits each year. If they can’t meet the target, they can buy regulatory credits from other automakers that have excess credits (like Tesla). As you can imagine, Tesla, as a pure ZEV manufacturer, always has excess credits to sell. And these credits flow 100% to the bottom line.

Tesla’s nine months net income as of 30 September 2021 was US$3,198 million, of which we know Tesla received US$1,151 million in regulatory credits. So, 36% of the profits Tesla receives has nothing to do with its operational business. Tesla’s free cash flow was US$2,240 million, which means 51% of free cash flow was due to regulatory credits. The sale of credits artificially boosts Tesla’s EBITDA, which is one of the benchmarks for Musk’s compensation.

While Tesla should obviously take advantage of the regulations right now (it’s free money after all), other automakers will increasingly produce their own range of ZEVs reducing their need to purchase credits. This means Tesla cannot rely on the sale of credits over the long term to which they have already acknowledged:

Irving Soh – fifthperson.com

What I’ve said before is that in the long-term regulatory credit sales will not be a material part of the business and we don’t plan the business around that. It’s possible that for a handful of additional quarters it remains strong. It’s also possible that it’s not.

CFO Zachary Kirkhorn

Yet regulatory credits were key for Musk to meet the EBITA targets, and in turn to get maximum possible compensation, long-term issues be damned.

Cooked performance targets: stock targets were short term

Another way the performance targets were made more easily achievable was to make the stock targets only need to last for 6 months. It should be noted that since Musk qualified for all tranches of compensation, the Tesla stock has decreased quite a bit from its peak of over $1T and has recently gone below both the $600B and $650B targets. This meant that using questionable statements/Tweets to pump up the stock in the short term could be enough to make the metrics achievable. This is absolutely not in the best interest of the stockholders!

The $56B Lawsuit

Dang. Turns out there are actual laws for making sure that there is proper board oversight, like the Sarbanes-Oxley act from 2002. This means that if the Directors of the Board are not adequately independent, like they are actually fellow drug bros with the CEO and profit handsomely from letting the CEO do anything he wants, then lawsuits can be filed. And for stocks on Nasdaq, like Tesla, the company can actually be delisted if it doesn’t show that it has an adequately independent board within one year or the next shareholder meeting.

Investors have for decades pressed for independent directors, especially at public companies, because it allows them to push back against management and closely monitor what is happening inside the business.

The sweeping set of rules known as Sarbanes-Oxley in 2002 mandated that public companies have independent directors, including on the audit committee. The rules came after the collapse of energy trading giant Enron, which later was found to have hidden its financials amid improper board oversight.

Stock exchanges generally spell out how they define independence on boards and other expectations. At private companies, there are no requirements for the number of independent directors, or what constitutes one. At Nasdaq, if a company doesn’t comply with its majority independent board rule, it gives the company one year or until its next shareholder meeting to make a change; if not, it may be delisted.

WSJ – 2/3/2024

A lawsuit was filed in 2018 by several law firms on behalf of a shareholder plaintiff, Richard Tornetta, who owned a few shares of Tesla stock. Such plaintiffs typically do not play a big role in the case, but can receive some compensation if a case is successful. It is not very glamorous. It will be the lawyers who receive many millions of dollars for the extensive legal efforts. But if you win you get a small financial award, and you can be immortalized.

In these cases, the plaintiff “is standing in the shoes of the company,” Jasnoch said, and sues its board or executives for actions that harmed the company. If the suit is successful, the financial benefits go to the company, while the plaintiff typically receives a small incentive award.

WSP – 2/1/24

Lo and behold, the lawsuit was successful and on January 30th, 2024, the judge determined that the process for awarding the $56B pay package was flawed, that the board was not adequately independent, and that there was inadequate oversight. Similar basis to the SolarCity lawsuit, but much more money at stake this time around, $56B vs $2B, and the many lawyers for the shareholders banded together well and got a big win.

When striking down Musk’s pay package on Tuesday, the Delaware Court of Chancery judge called the process for approving it “deeply flawed” and cited Musk’s “extensive ties” to some of the directors who negotiated it. A Tesla shareholder had sued, alleging Musk played too big a role in deciding his own pay.

Musk “enjoyed thick ties with the directors tasked with negotiating on behalf of Tesla, and dominated the process that led to board approval of his compensation plan,” wrote Chancellor Kathaleen McCormick in the opinion. She described board Chair Robyn Denholm’s approach to her oversight obligations as “lackadaisical.”

WSJ – 2/3/2024

Ironically, just two weeks before the legal decision, Musk had demanded that the board give him much more stock so that he would own 25% of Tesla. This would be on top of the $56B already given to him. Talk about going big! Turns out that he reduced his stake in Tesla by selling more than $39 billion of the carmaker’s stock in 2021 and 2022, at least partly to help pay for his purchase of the company formally known as Twitter. This further shows that the Twitter acquisition has significantly impacted Tesla.

The key threat Musk used to demand another big pay package is that otherwise he will develop robotics and AI outside of Tesla.

Chief Executive Elon Musk has gone public with a demand for another big pay package, saying he wants more shares and greater control over the electric-car company as it expands further into robotics and artificial intelligence.

On Monday, Musk gave board members what amounts to an ultimatum, saying he feels uncomfortable making Tesla a leader in those two areas without controlling roughly 25% of the company.

“Unless that is the case, I would prefer to build products outside of Tesla,” Musk wrote on the social-media platform X.

WSJ – 1/16/2024

The funny thing is that Tesla is a car company. Robotics and AI efforts simply distract them from their core business of manufacturing cars. This means that if Musk instead does that expensive work outside of Tesla it would actually greatly benefit Tesla financially since Tesla robotics and AI will be about as lucrative as Hyperloop. But we shall see if the board is actually independent now and follows their fiduciary responsibility, or if they instead shovel lots more money to their buddy Elon.

Enter the Heavy Metal Drummer

I know you have been waiting for this.

The judge ruled that the Tesla board of directors did not exhibit proper oversight when awarding Musk’s pay package. Musk almost never loses lawsuits. And no one has personally lost $56B before. But who was this David who went against the Goliath? Who is Richard Tornetta, the plaintiff shareholder?

While it is true that Tornetta only owned 9 shares of Tesla, this is a typical situation. Large institutional shareholders were very interested in the lawsuit happening, but being the lead plaintiff could jeopardize future Wall St deals for them. Therefore it is best for somewhat of a figurehead to instead be be the plaintiff. And for all of this, Tornetta is now immortalized forever.

Experts said people like Tornetta are vital for policing boardrooms. Lawmakers and judges have long wanted large investment firms to lead such corporate litigation since they are better equipped to keep an eye on their lawyers’ tactics. But experts said fund managers do not want to jeopardize relationships on Wall Street.

So it was up to Tornetta to take on Musk.

“His name is now etched in the annals of corporate law,” Talley said. “My students will be reading Tornetta v Musk for the next 10 years.”

Reuters – 2/1/24

But the absolute best part of this whole story is that Tornetta can be seen in videos drumming at the legendary former New York club CBGB with his now-defunct metal band “Dawn of Correction”, which described its sound as “a swift kick to the face with a steel-toed work boot.” Little did they know that Dawn of Correction was excellent foreshadowing for the start of the Tesla stock price correction this year.

But to really appreciate this individual who cost Elon Musk $56B you have to watch this video. Richard Tornetta is soooo worthy!

Wait, I’ve totally lost the connection to Full Self Driving you promised???

The point is, Musk believes in go big, or go home. If going big takes a some fudging, like promising certain features or a certain timeframe, we need to always remember his track record. In fact, there is a whole website elonmusk.today that has taken on the monumental task of keeping track of all of Elon’s broken promises.

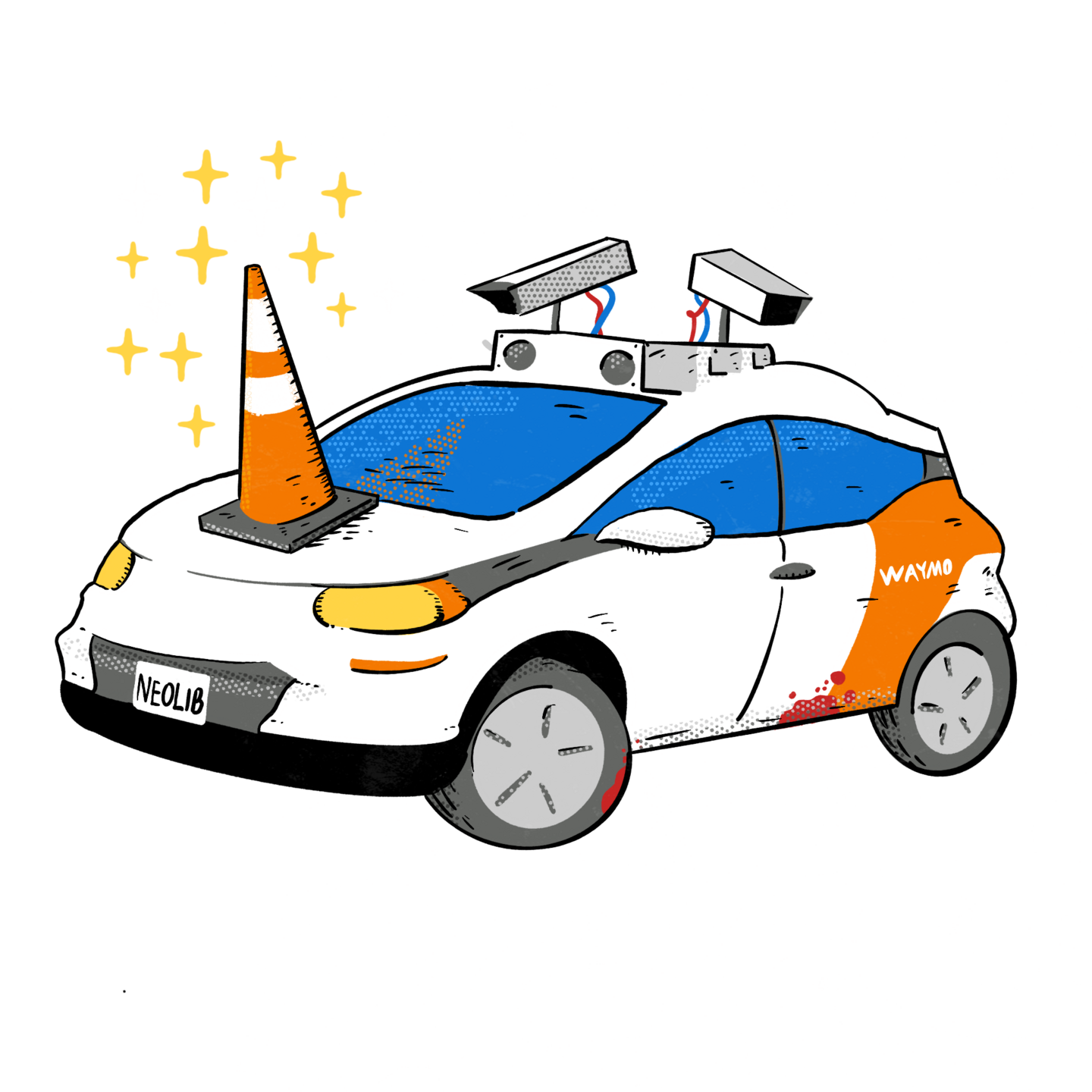

FSD is just another Musk fantasy, but one that is very useful to him. But wait, doesn’t FSD actually exist?? Yes, it does. And fanboys love it. But as with other Musk promises, it will never live up to its name. Elon himself crippled it by cheaping out on using adequate sensors. And him relying on hype alone shows that it will never be adequately safe.

The robotaxi will be built from the ground up without pedals or a steering wheel, despite objections from engineers who pushed for a safer design concept on the basis that Tesla’s “Full Self-Driving” (FSD) software wasn’t there yet, according to excerpts from the book. FSD is Tesla’s upgraded advanced driving assistance system that can automate some driving tasks in city and highway environments, but is not yet a fully autonomous system. It relies only on cameras, rather than a suite of sensors including lidar and radar, to collect information about its environment, as well as Tesla’s Dojo supercomputer to make quick decisions.

Musk apparently stood his ground. He told his designers in an August 2022 meeting, “Let me be clear. This vehicle must be designed as a clean robotaxi. We’re going to take that risk. It’s my fault if it fucks up. But we are not going to design some sort of amphibian frog that’s a halfway car. We are all in on autonomy.”

TechCrunch – 9/12/23

When the car is FSD without supervision, ie robotaxi, you’ll be able to earn far more than monthly lease/loan cost by allowing others to use it. Managing a small fleet of robotaxis will be a career for many & much better than driving a single car.

— Elon Musk (@elonmusk) October 12, 2019