Investors excited by Tesla flimflammery, while execs clearly see the impending disaster

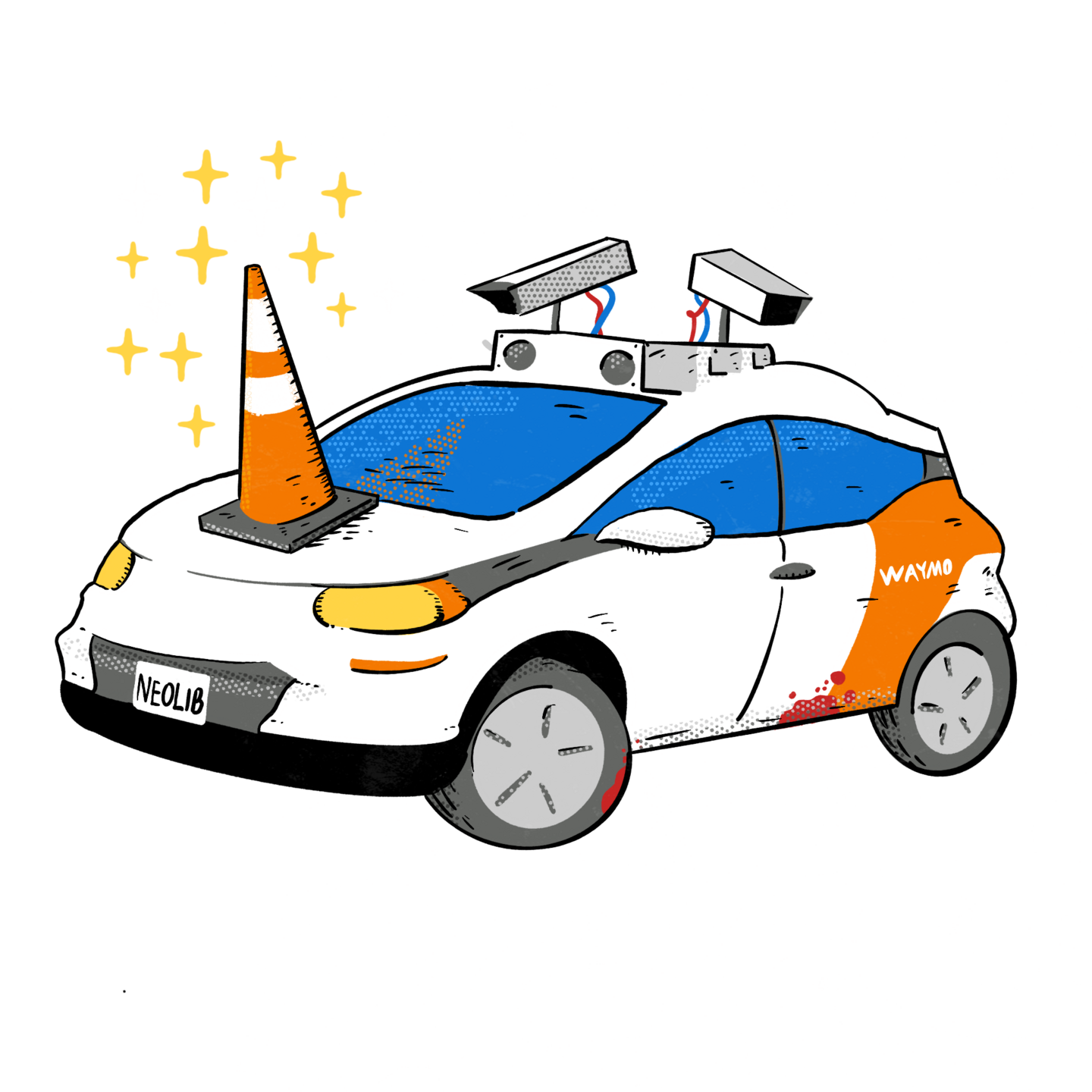

The Tesla earnings call on April 23rd was quite interesting. Everyone knew that sales for Q1 had plummeted by 9% xxxxxx. Everyone knew that Musk had cancelled the critical low-cost Tesla that is critical to their future. And everyone knew that Musk was touting that the future of Tesla was their vapor robotaxi, that is based on bad design decisions and weak technology.

But Musk promised lied a new low-cost Tesla, maybe even by the end of the year. Even through in a bunch of mumbo jumbo word salad about revolutionary manufacturing techniques that would greatly reduce manufacturing cost.

Tesla stock should have of course gone down, but instead enough investors bought his story.

The only positive for investors is that Tesla might have officially become a meme stock, where thinks like sales and profit are irrelevant. Instead, just need some mumbo jumbo from Elon and some investors jump on the bandwagon.

But we all know that developing a new car takes at least 3 years. When a company is in the midst of layoffs and executive departures it will take even longer. Long before the vehicle is actually available for sale there will be prototypes presented to the press and investors. But of course there is not a single sign of a Tesla low-cost vehicle. No specs, no pictures, nothing. A company cannot create a low-cost car just by announcing it. Yet enough investors took the bait. They deserve what they get when next quarter there is still no sign of a low-cost Tesla nor a viable robotaxi.

A big FU from Tesla execs

While investors continue to fall for the smoke and mirrors of Elon, key execs see exactly what is going on and are jumping ship. Not just quitting with a benign announcement of “spending more time with family,” but instead leaving in spectacular style.

If somebody doesn’t believe Tesla’s going to solve autonomy, I think they should not be an investor in the company.

Elon Musk

On April 15th, just a week before the Q1 earnings call, executives Drew Baglino and Rohan Patel suddenly resigned. Baglino had worked with Tesla since 2006 and most recently reported directly to Musk as the company’s senior vice president for powertrain and energy engineering. Reporting directly to Musk, Baglino was seen as the unofficial chief of operations by many colleagues.

In an epic FU and a remarkable show of lack of faith in Elon and Tesla, Baglino quickly dumped $181.5 million of Tesla stock after previously selling a few million dollars worth earlier this year.

Rohan Patel, the other Tesla exec who resigned on April 15th, was more circumspect though certainly not more forthcoming. Patel’s explanation for suddenly leaving Musk and Tesla was “My plans are to be a recess monitor for my 2nd grade daughter, practice my violin, go to a bunch of bucket list sporting events and take my very patient wife on some long intended travel.” Sure sounds a lot better than cleaning up Elon’s messes.

But there is more. At the end of the earnings call, Martin Viecha, Tesla’s vice president of investor relations, surprisingly announced that he, too, was resigning. For seven years Viecha was key with respect to Tesla investors and was well known and appreciated. To announce that he is suddenly leaving Tesla during the earnings call is nothing short of shocking. Although Viecha did not provide specific details about his plans, he expressed his intention to take a break and “spend quality time with his family.” Yet another strong vote of no confidence in the supposed plans Elon Musk has for Tesla.

And keep in mind that Jack Kirkhorn, the CFO of Tesla and a top contender to replace Musk as CEO, resigned in August of 2023. No reason was given for his departure after being at Tesla for 13 years. And of course there were two other CFOs, Deepak Ahuja and Jason Wheeler, who resigned previously. Apparently being the CFO at Tesla is quite precarious, having to deal with the whims of folly of Elon all the time. But hey, no Tesla CFOs have gotten into legal trouble … yet!

Next

The next earnings call will be in July. Note how that is conveniently just before the great Tesla robotaxi announcement schedule by Elon for 8/8. I’m confident that Tesla will have had another disaster quarter with lower sales and much lower profits. But hey, Elon will provide the word salad news on the how the low-cost Tesla is progressing just great, though any details are just confidential. And the robotaxi service will be announced shortly, saving billions and billions of lives. Enough investors will take the bait and the stock likely won’t tank.

But the Q3 earnings call in October? Just make sure to bring some popcorn!

Investors will realize they’ve been had.

Update

I was happy to see that I am not alone with my thoughts.

Elon Musk has a strategy and you may have seen it before: When things aren’t going well, he’ll say something wild to take everyone’s eyes off the trouble, and raise share prices with dreams.

Take last night’s earnings call as an example.

The first quarter of 2024 didn’t go well for Tesla, either economically or reputationally. As we reported earlier, sales fell, net profit tumbled off the same cliff Tesla’s stock price earlier careened over, and production and deliveries decreased as well.

But give Musk a chance to toss out a flash grenade and he’ll do just that: This time around with some wild predictions about his automaker producing a “purpose-built robotaxi” dubbed the “Cybercab,” and Tesla’s latest vision for the future as one in which it is focused on “solving autonomy.”

Brandon Vigliarolo – The Register