NY Times – The Very Slow Restart of G.M.’s Cruise Driverless Car Business

An incident that seriously injured a pedestrian in San Francisco led Cruise to take all of its cars off the road. The question now is when they will return.

Editors note: The article brings up an interesting point. Cruise has resumed autonomous driving in Phoenix, but with two, yes two human safety drivers! This really shows that their technology can still not be trusted. A key point the article misses though is that Cruise is quickly running out of money. They only have enough money to last through the third quarter ’24. After that GM would have to pour a lot of money into Cruise to keep it going. Given that there is no possible path to profitability in sight we have to expect GM to put Cruise out of its misery by end of this year.

See original article by Yiwen Lu at NY Times

At a sprawling complex in Warren, Mich., General Motors’ hopes for its driverless car future play out in a virtual reality headset offered to visitors.

In a video, the electric and autonomous car drives itself. Wirelessly connected to traffic lights and the surrounding streets, the car avoids collisions and reduces congestion, part of what G.M. calls its “0-0-0” vision — “zero crashes, zero emission, zero congestion.”

At least, that’s the plan. G.M.’s driverless future looks a lot further away today than it did a year ago, when Cruise, G.M.’s driverless car subsidiary, was deep into an aggressive expansion of its robot taxi services, testing in 15 cities across 10 states.

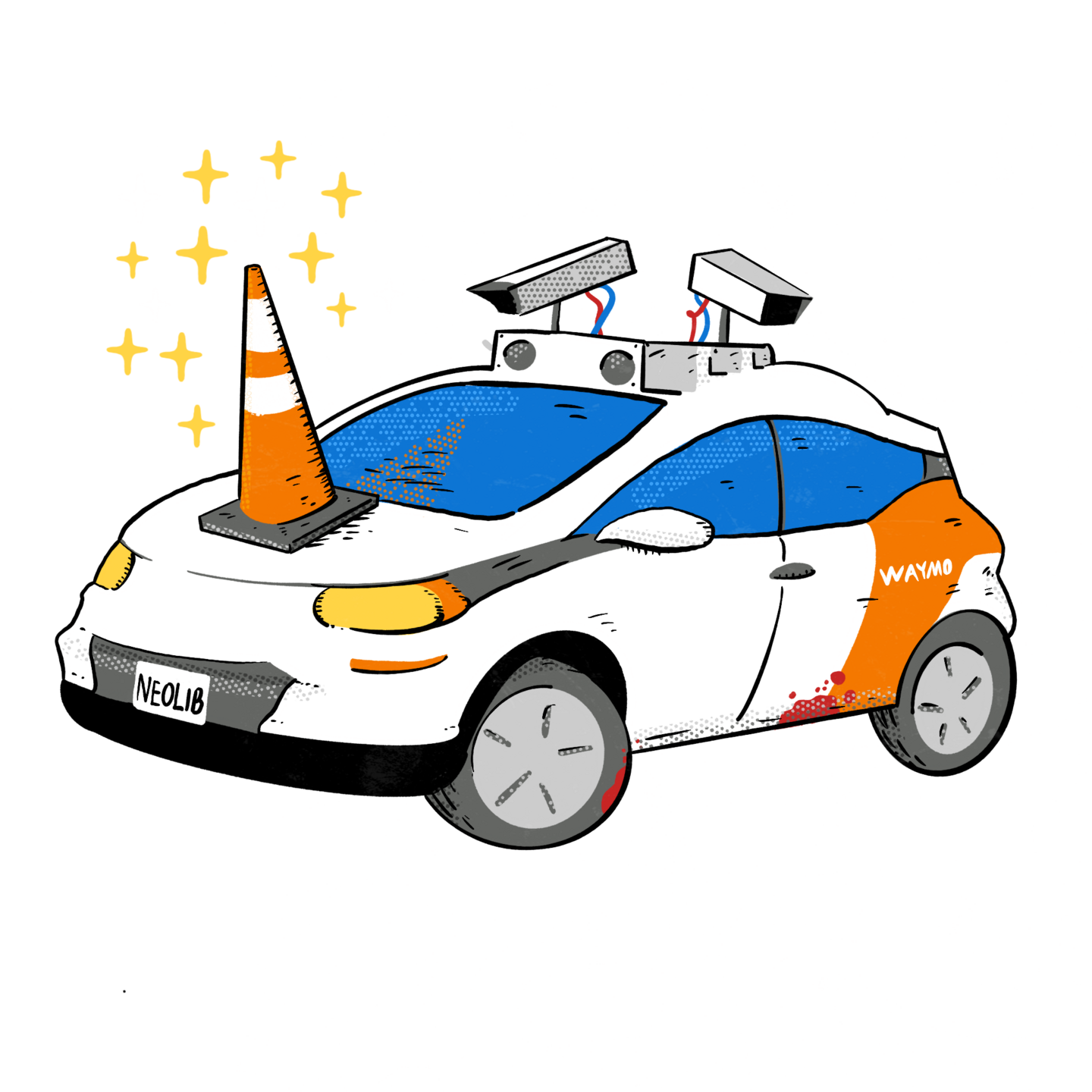

On Oct. 2, a Cruise driverless car hit and dragged a pedestrian for 20 feet on a San Francisco street, causing severe injuries. Weeks later, the California Department of Motor Vehicles accused Cruise of omitting the dragging from a video of the incident that was initially provided to the agency and suspended the company’s license in the state.

In November, Cruise voluntarily paused all operations across the country after facing widespread criticism that it was neglecting safety as it expanded its driverless taxi service. Cruise also pushed out nine executives, its chief executive stepped down, and the company laid off a quarter of its work force.

Now comes the hard part: Rebuilding a ruined reputation. In recent interviews with The New York Times, the three executives now running Cruise say they are in no rush to get back on the road. After learning the hard way about the risks of moving too fast with a cutting-edge technology, Cruise has slowed its breakneck development to a crawl to avoid another major mishap.

“For a long time before, Cruise was really moving fast and other competitors were not,” said Craig Glidden, who became president and chief administrative officer of Cruise in November. Now, he said, safety is Cruise’s “North Star.”

But going slow means the company risks falling far behind its top rivals. Waymo, a subsidiary of Google’s parent company, Alphabet, has had driverless taxis operating in the Phoenix area since 2020 and San Francisco since late 2022 without serious incidents, and it recently expanded to Los Angeles. Zoox, an Amazon subsidiary, has been testing a steering-wheel-free robot taxi in Las Vegas since last June.

“Catching up with Waymo technologically is going to take three to five years at best,” said Alex Roy, a consultant and former executive in the autonomous car industry. He added that it was even harder for Cruise to catch up commercially because Waymo was “generating revenues with trust that Cruise never earned.”

Some industry observers were surprised G.M. didn’t shut down Cruise after its public meltdown late last year. Since acquiring the company in 2016, G.M. has spent over $8 billion on its driverless subsidiary. Cruise lost $3.48 billion last year, and another $519 million over the first three months of 2024.

“I was thinking in the late part of 2023 and into early 2024 that the most likely outcome was that they were going to completely turn off Cruise,” said Reilly Brennan, a partner at Trucks Venture Capital, which invests in the future of transportation.

But after slashing $1 billion from Cruise’s 2024 budget, Mary T. Barra, G.M.’s chief executive, reiterated her commitment to the company during earnings calls. In April, she told investors that Cruise had made “tangible progress,” although G.M. is exploring different options to fund the business, including taking outside investments.

After Cruise’s former chief executive and co-founder Kyle Vogt resigned in November, G.M. appointed two presidents who report to its board: Mo Elshenawy, previously the company’s executive vice president of engineering, and Mr. Glidden, who also serves as G.M.’s general counsel. In February, Cruise hired Steve Kenner, a veteran product safety executive, as chief safety officer.

The three executives all decide on safety decisions, such as when to take the next step in deployment. Those calls, Mr. Kenner said, have to be unanimous.

So far, Cruise has taken baby steps back to the road. In April, it picked Phoenix, the home to its operations center, to be the first city to restart testing with human drivers. On May 13, after a month of driving a handful of vehicles in order to understand local road features, Cruise transitioned into supervised autonomous testing, with two safety drivers per vehicle.

Cruise used to say its robot taxis were, on average, safer than a human driver. But so-called edge cases — incidents like road construction or erratic cyclists that humans can intuitively react to — bedeviled the robot taxis. Mr. Elshenawy said the cars had improved their navigation of construction zones and how they deal with emergency vehicles.

Cruise hopes to offer driverless ride-hailing service in one city by the end of 2024, while operating with safety drivers in fewer than five cities, Mr. Glidden said. That is, if the edge case issue can be improved.

While Mr. Elshenawy’s engineering team works to improve the technology, Mr. Glidden and Mr. Kenner have been traveling across the country to meet with regulators. Cruise has met with local officials and state regulators in Arizona, Texas and California, as well as with the National Highway Traffic Safety Administration. It has also spoken with several cities in the Southeast where it previously tested its fleet.

In California, Cruise has answered questions from state regulators about driverless testing, but it is unclear if or when it could regain a permit. The talent pool in Silicon Valley is essential to Cruise’s business, so executives say they are committed to staying in the state.

Whether Cruise’s cautious approach restores faith in the company among regulators is an open question. Dave Cortese, a California state senator representing Silicon Valley, said the autonomous vehicle industry’s aggressive testing on public roads in the past had “created tension and distrust.”

For the company to win over regulators, it needs a “profound demonstration of transparency” to demonstrate that an incident like Oct. 2 will not happen again, said Mr. Roy, the consultant.

“We may not agree, but I think there are lots of places where we do agree,” said Tilly Chang, executive director of San Francisco County Transportation Authority. “But it is also unclear to us what it would take for them to get reinstated.”

See original article by Yiwen Lu at NY Times