NY Times – SoftBank’s Chief Pitches a New Path for Self-Driving Cars

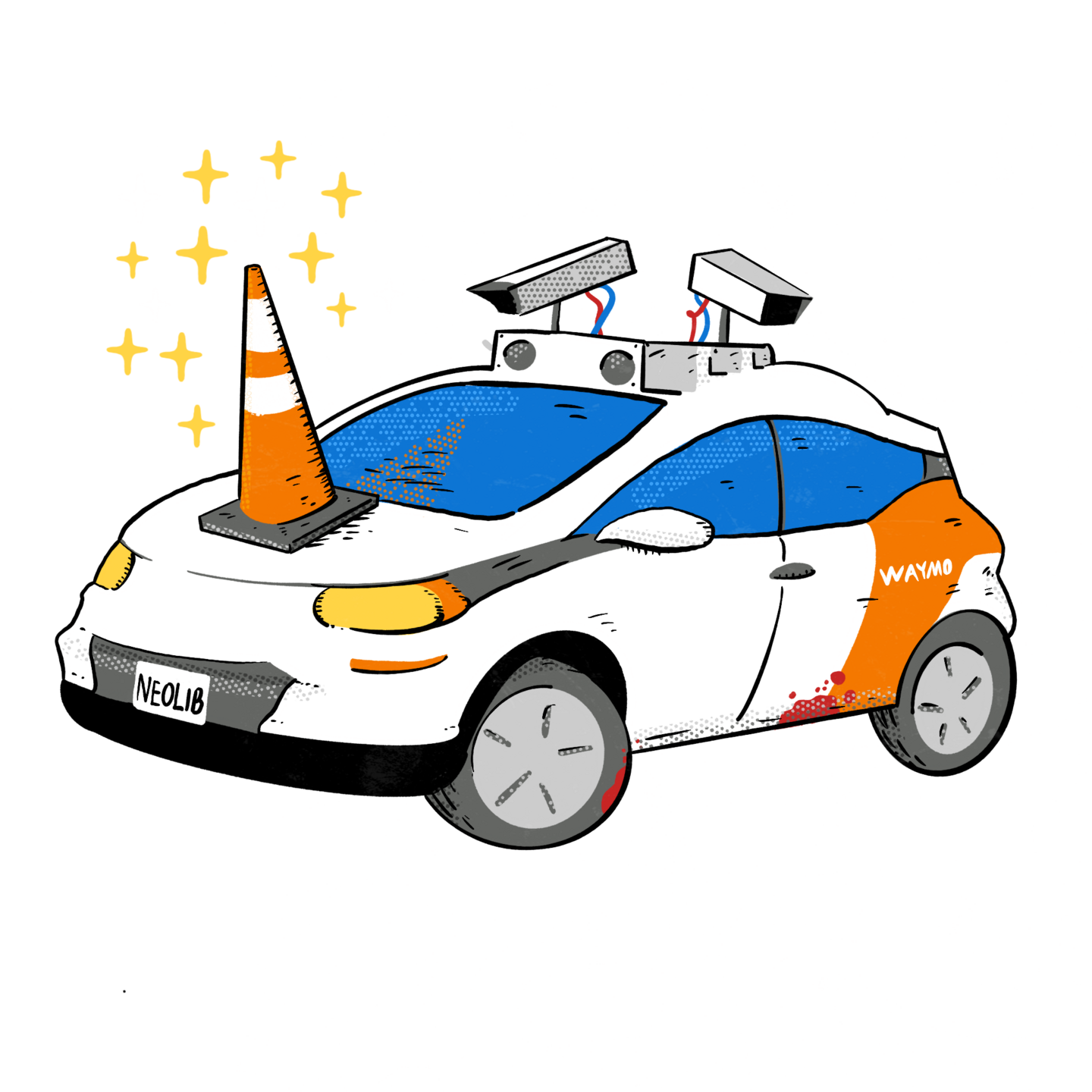

Editors note: the article reports on how unnamed analysts claim that Tesla is a leader in autonomous driving and that the other auto manufacturers need to catch up with. But the truth is that Tesla does not have AV technology. They only have driver assist tech, and it is rather flawed and deadly.

Also, Masayoshi Son is the prime example of “even a stopped clock being correct twice a day”. Son was lucky with his Alibaba investment in 2000, which is the source of their wealth. And currently Son is ahead due to large investments in AI, which are temporarily doing well because of the AI hype cycle. But otherwise Son has been completely off base with their prognosis. See the story of WeWork for a prime example.

See original article by River Akira Davis at NY Times

Masayoshi Son, the billionaire founder of SoftBank, is trying to rally automakers around the world to join forces on autonomous-driving technologies.

Masayoshi Son has long prided himself on his ability to detect big shifts in technology early on. During his four decades leading SoftBank, a free-spending Japanese investment group, the billionaire has made some spectacularly successful investments. And some epic flops.

In recent months, Mr. Son has been laying out plans for a new big bet: self-driving cars.

Befitting his maverick approach, Mr. Son’s pitch does not resemble other efforts to develop autonomous vehicles. He is trying to convince automakers from around the world, rivals under most scenarios, to work together to use artificial intelligence to accelerate autonomous driving advances. That way, the thinking goes, they will be able to overcome the challenges that have led some to abandon self-driving car efforts.

In recent months, Mr. Son, 66, has summoned automotive executives to a tatami-mat-floored room at the top of a skyscraper in Tokyo Bay to discuss the idea, including the chief executives and autonomous-driving leaders of Honda Motor and Nissan Motor. He has also spoken with the chief executive of Uber.

Mr. Son’s vision is to assemble a group of auto companies across the United States, Japan and Europe that would pool resources, including the vehicle-driving data crucial to autonomous-driving systems, according to five people briefed on his plans who were not authorized to speak publicly.

Most driverless car projects today rely on high-definition maps to help vehicles navigate, but these maps can become outdated, and vehicles are restricted to operating only in certain areas. Mr. Son is pitching a model in which cars can navigate — potentially anywhere — using a powerful A.I. computer system that would guide vehicles through everything they encounter on roads. That system would need to be trained using massive amounts of data.

Spokespeople for SoftBank, Honda, Nissan and Uber declined to comment.

SoftBank has a number of investments in A.I. and related industries, including a majority stake in the semiconductor design firm Arm. SoftBank would stand to benefit if technologies offered by the companies it has invested in were adopted by the autonomous vehicle coalition that Mr. Son hopes to assemble.

Mr. Son’s overtures come as self-driving vehicle efforts have hit a bumpy period. The technologies for these cars are expensive, difficult to develop and face intense regulatory scrutiny. Some major companies have recently become more cautious about pouring cash into these projects.

Apple recently abandoned its self-driving car efforts after years of development. Cruise, the General Motors self-driving subsidiary, removed its driverless cars from the road last year amid safety and legal concerns, though it has since resumed limited testing. The previous year, Ford Motor said it was shutting down Argo AI, its autonomous-driving venture.

Analysts say that China, which is testing more driverless cars on public roads than any other country, and Tesla, which has promised to unveil a “robotaxi” this year, are far ahead of most traditional automakers in developing autonomous vehicles. [Editors note: the previous statement is incorrect] Even if the established American, European and Japanese auto giants were to band together under direction from SoftBank, there would be no certainty that they could catch up.

At the same time, some in the industry think the boom around A.I. is reinvigorating the development of self-driving. This is where Mr. Son, who is leading a multibillion-dollar effort to reinvent SoftBank as an A.I. powerhouse, comes in.

Through the years, Mr. Son has built a name for himself as one of the world’s most prolific and aggressive tech investors. Sensing the rise of e-commerce in China, Mr. Son invested $20 million in the internet company Alibaba in 2000. The investment ultimately became one of the most profitable in history, netting his company tens of billions of dollars. A less prescient bet on WeWork led to losses of more than $14 billion when the office-leasing company filed for bankruptcy late last year.

SoftBank has been on a tear recently, with its shares setting record highs thanks to better financial results from its investment unit and gains from its stake in Arm that, like other companies in the chip industry, has had its shares soar on enthusiasm for computing-heavy A.I. systems.

As of the end of March, Mr. Son had close to $40 billion of cash at SoftBank to back more rounds of the giant investments, emphatic pronouncements and whimsical, unicorn-stamped slide decks he is known for.

Last month, Mr. Son returned to the public spotlight for the first time in more than half a year — a period he said he spent reflecting, at times tearfully, on how SoftBank could lead the A.I. revolution. (Last year, Mr. Son told a shareholder meeting that he “couldn’t stop crying for days” at the thought of ending his career with investment losses.)

Speaking with a raspy voice at last month’s shareholder meeting, Mr. Son said that after several nights of fitful sleep, “his head was clear,” having rediscovered the purpose of his existence.

“SoftBank Group has done many things up until now. All of these were warming up for A.S.I.,” Mr. Son said, referring to what he calls “artificial super intelligence,” a form of A.I. that he defines as 10,000 times smarter than human intelligence. “Why was Masayoshi Son born?” he asked. “I was born to make A.S.I. a reality.”

During the shareholder meeting, Mr. Son dropped few hints about his plans, but spoke frequently about autonomous driving.

Like many other proponents of self-driving technology, Mr. Son says the point is not simply to save people from the chore of driving, but to reduce the number of people who die in accidents. In this way, “A.S.I. will be capable of saving us from despair,” he said at the shareholder meeting.

From a commercial perspective, several SoftBank-backed companies would most likely benefit from the alliance Mr. Son envisions.

Earlier this year, Mr. Son led a $1 billion investment in Wayve, a maker of A.I. systems for autonomous vehicles. Arm has also been trying to expand beyond the mobile processors it has long been known for and push deeper into the automotive business. The company recently unveiled a class of chip designs and other systems for self-driving cars.

Will Mr. Son’s autonomous-vehicle dreams ever materialize? Two people close to Mr. Son cautioned that the billionaire was full of ideas, including about self-driving cars, and that many of those ideas do not end up being put into practice. Autonomous driving is also just one part of Mr. Son’s broader plans for transforming society using A.I., they said.

Automotive executives approached by Mr. Son said they had lingering concerns about how much time and money A.I.-powered autonomous vehicles would take to develop, according to two people familiar with the executives’ thinking. Any cooperation between carmakers would also have to take increasingly strict antitrust scrutiny into account.

But there is one part of Mr. Son’s pitch that auto industry leaders find particularly convincing: They need to find a way to hasten autonomous-driving efforts so that they are not left in the dust by the likes of Tesla and carmakers from China.

During one meeting, according to a person with knowledge of the event, Mr. Son was asked how, as he saw it, rival auto companies could compete with one another in self-driving cars if they all drew data from the same pool. His response was simple: with speed.

See original article by River Akira Davis at NY Times