NY Times – Waymo’s Robot Taxis Are Almost Mainstream. Can They Now Turn a Profit?

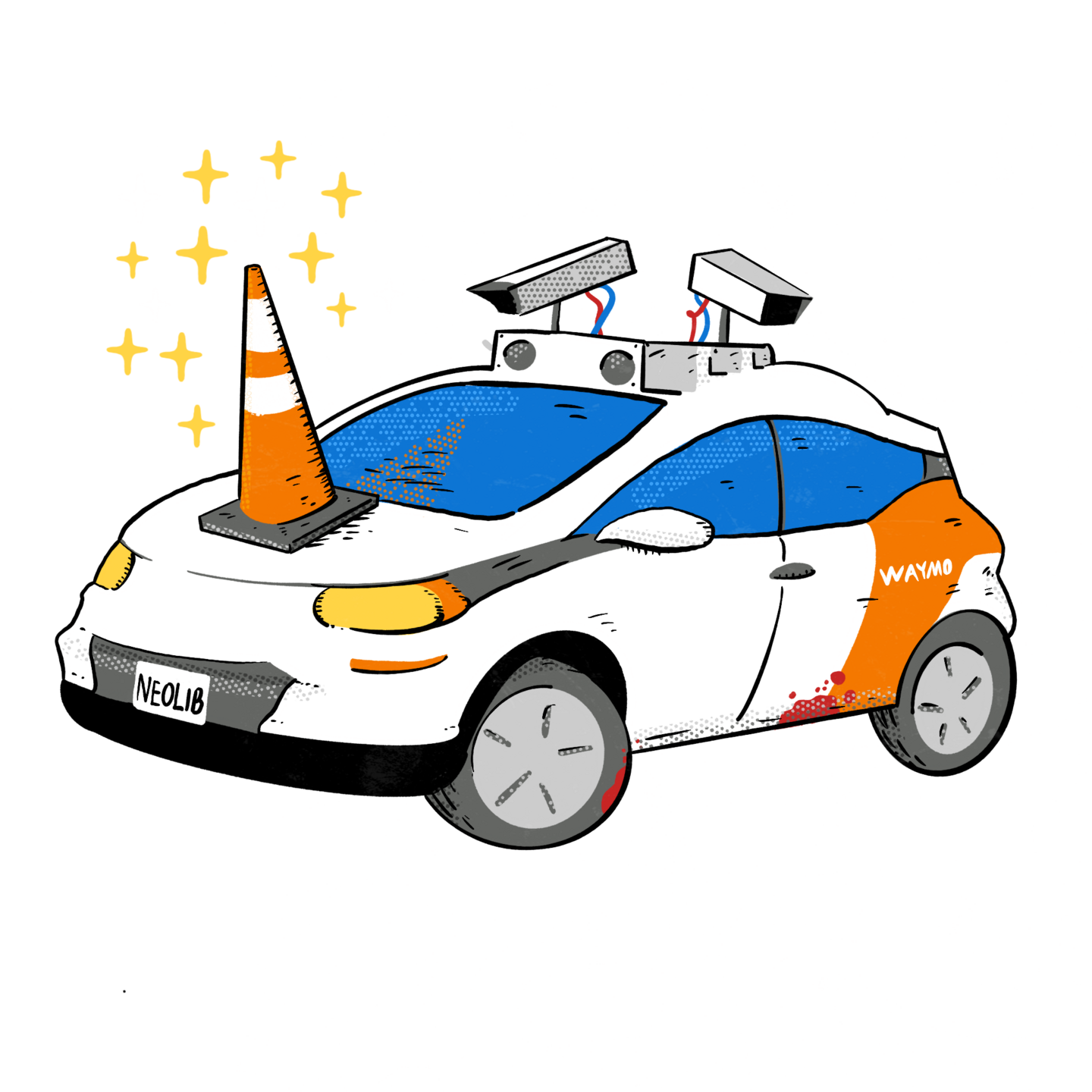

Editors note: business viability is the keep issue for robotaxis. They will never be truly autonomous, and therefore require lots of human help and remote driving. They will never be cheap since they require a large investment in capital for electronics and sensors. The software will never be done and will require an ongoing huge investment. And unlike Uber and Lyft, robotaxis require the companies to pay for the costs of the vehicles, maintenance, insurance, and more.

And while Alphabet/Google/Waymo have been drastically downscaling their investments of late and requiring their projects to bring in money or be closed down, recent court decisions on them being a monopoly will require them to be even more financially prudent in the future.

I continue to predict that Waymo will drastically change (most likely start winding down) by end of 2025.

See original article by Eli Tan at NY Times

Now that its technology is showing it can work on city streets, Alphabet, which owns Waymo, plans to invest billions more.

Over the last few months, Waymo’s robot taxis have become an unmistakable part of the San Francisco experience.

Once a novelty service that opened last year for limited downtown trips, Waymo rides are now open to the general public, ubiquitous on the city’s hilly roads. The company, which is owned by Google’s parent, Alphabet, has also expanded onto California freeways and into Los Angeles.

Waymo is now completing over 100,000 rides each week in San Francisco, Phoenix and Los Angeles — double the number in May. And on a July earnings call, Alphabet executives said the company planned to invest an additional $5 billion in Waymo.

But there is still a big question about whether Waymo’s robot cars can become a profitable business. And some wonder whether Waymo will one day move away from the business of managing car fleets and focus on selling its technology to other companies.

That Waymo has gotten to this almost-mainstream point can be credited to both the billions that Alphabet has spent on its yearslong autonomous vehicle project and its patience with the technology.

While robot taxi services are not profitable right now, Waymo and other autonomous vehicle companies like General Motors’ Cruise and Amazon’s Zoox are vying for a share of a market that could one day be worth as much as $5 trillion, some analysts estimate.

Right now, Waymo is far ahead of the competition. Its dominance has grown since Cruise, its main rival, was ordered to pull its fleet off the road after a pedestrian was seriously injured in an incident involving one of its cars in San Francisco in October.

“At this point, the fully autonomous driving industry is really just an industry of one: Waymo,” said John Krafcik, a former chief executive of Waymo and a member of the electric vehicle company Rivian’s board.

It’s unclear exactly how much money Alphabet is spending on Waymo, but a collection of Alphabet’s experimental businesses that includes Waymo had an operating loss of about $2 billion in the first half of this year. Waymo most likely accounted for a significant portion of that loss, said Mark Mahaney, the head of Evercore ISI’s internet research team.

Waymo is charging prices similar to Uber’s and Lyft’s, but unlike those companies — whose profit margins are at best slim — Waymo has to pay for its fleet, along with real estate for storage and recharging.

The equipment on Waymo’s fifth-generation robot taxis — electric Jaguar I-Pace vehicles — costs as much as $100,000, Dmitri Dolgov, Waymo’s co-chief executive, said on a podcast in February. And while Waymo doesn’t have to pay for drivers, it employs technicians behind the scenes to monitor rides.

Saswat Panigrahi, Waymo’s chief product officer, said in an interview that the company was betting that its fixed costs, like the expense of lidar sensors and the number of human monitors it needs, will decrease over time.

Waymo’s sixth-generation vehicles, which it started testing in July, will also lower costs, Mr. Panigrahi added. “So as we swap these fleets out, the profitability will jump further,” he said. The new vehicles are made by a Chinese electric automaker, Zeekr.

Autonomous vehicle experts see a few different market fits for robot taxis. A handful of major cities like New York and Chicago, where the demand for ridership is the most concentrated, could mimic Waymo’s rollout in San Francisco.

This would most likely include operating at major airports, which have long been cash cows for Uber and Lyft. Waymo currently stewards passengers to and from Phoenix Sky Harbor International Airport, and is in talks to expand into San Francisco International Airport, according to emails viewed by The New York Times.

But large cities also present challenges like chaotic traffic, stricter regulations and competition with public transportation.

Other markets for robot taxis could be regions where the demand for ride hailing exceeds the availability of drivers, or midsize cities without strong public transit systems, like Atlanta and Las Vegas. Waymo has so far tested its vehicles in more than 25 cities, Mr. Panigrahi said.

“If we were to look at the greater New York area, you may not see service in Manhattan,” said William Riggs, a professor at the University of San Francisco who studies autonomous vehicles. “You may see a large propensity for profit in Hoboken, or in Westchester County or even Long Island.”

There is also the long-term possibility that companies like Waymo ditch or outsource their fleets to focus on selling software and operating systems to companies like Uber.

Mr. Panigrahi said that Waymo did not want to be in the long-term business of changing tires, but that building out each component of an autonomous vehicle on its own had been necessary in the technology’s early stages, and as a safety measure.

Uber, which sold off its autonomous vehicle division in 2020, has already teamed up with Cruise and Waymo to display their autonomous rides in its app in certain cities.

While Waymo has avoided much of the public scrutiny about safety that plagued Cruise, its fast expansion has worried some safety experts and local officials who say the company has not been transparent about making its traffic data public.

California law does not require Waymo to report all of its traffic data to agencies. That has left local transportation officials in the dark when determining policy, and some safety experts are especially nervous about robot taxis malfunctioning on high-speed freeways.

Mr. Panigrahi said that safety remained a top priority for Waymo, and that autonomous vehicles could save thousands of lives as a safer alternative to distracted or impaired drivers.

To boost its reputation in San Francisco after the Cruise fallout, Waymo sponsored outdoor movie nights and concerts in parks across the city, and its robot taxis have become a tourist draw. But public trust can be easy to lose, as Cruise learned.

“Waymo has not had the big crash yet,” said Phil Koopman, an engineering professor at Carnegie Mellon University who specializes in autonomous vehicles. “I don’t know if they will have a big, embarrassing, problematic crash, and based upon the data, they don’t know, either.”

See original article by Eli Tan at NY Times