The Verge – Cruise lost $435 million this quarter, even with its robotaxis on hiatus

Editors note: Cruise is still losing money at a yearly rate of $1.7B/year. And for 2025 the loss could be even worse, up to $2B. GM, their parent company, cannot maintain this for much longer. And though GM says they will announce new “funding model” in the next few days, there is no way this will dig them out of their huge financial hole. GM needs to jettison this flaming dumpster fire ASAP.

See original article by Andrew J. Hawkins at The Verge

/ GM needs to prove driverless cars can be safe but also profitable.

Even with most of its autonomous vehicle fleet on ice, Cruise is still bleeding cash. The robotaxi company that is a wholly owned subsidiary of General Motors lost $435 million in the third quarter of 2024, GM reported this morning. That’s an improvement from the $791 million lost in the third quarter of 2023.

It’s an instructive moment to check in with Cruise because the company has been on hiatus since October 27th, 2023, weeks after one of its driverless vehicles in San Francisco struck and then dragged a pedestrian over 20 feet, severely injuring her.

Cruise has made small steps toward restarting its robotaxi service since then, with test vehicles on the roads in Arizona and Texas. It recently announced plans to deploy manually driven vehicles in the Bay Area later this year, but it still hasn’t said when it will resume its paid commercial service.

Cruise is unique in the world of autonomous cars in so far as we have much more insight into the company’s finances than nearly all of its competitors. Since GM breaks Cruise out in its earnings reports, we know about its net sales and revenue ($26 million for Q3), its total cost and expenses ($442 million), and its operating income (a loss of $417 million).

Investors are no doubt pleased that GM has succeeded in stemming some of its losses with Cruise. The robotaxi subsidiary lost a staggering $3.48 billion in 2023 and has been seen by some as an albatross for the automaker, sucking up cash and lacking a clear path to profits.

But GM CEO Mary Barra has long been bullish on autonomous vehicles — perhaps more than is warranted. Other automakers have pulled their investments out of fully driverless cars, tired of continuing to pour money into a project without a clear sign of returns on the horizon. But Barra doubled down. In 2022, she took the stage at the annual Consumer Electronics Show and boldly declared that GM would sell fully autonomous vehicles to regular people by the middle of the decade.

I think it’s safe to say that GM won’t meet that deadline. But while investors have encouraged GM to cut their losses with Cruise, she has stuck by the project. This past year, Barra has directed a reorganization at Cruise, ousting its founders and replacing them with auto and tech industry veterans.

There have been other cost-cutting measures. Cruise laid off 25 percent of its workforce and canceled its Origin project, a driverless shuttle without a steering wheel or pedals, absorbing a $534 million loss in the process. And it agreed to pay millions in fines to state and federal regulators to settle investigations into its response to the pedestrian-dragging incident.

“We will continue to be disciplined with our investments in Cruise,” Barra said during an investor event earlier this month. She also said the AV division would only lose no more than $2 billion in 2025.

And in an earnings call on Tuesday, Barra said that GM would have news to share in the days to come about Cruise’s “funding model” — implying that there would be partners brought on to help defray the cost of operating a fleet of driverless cars.

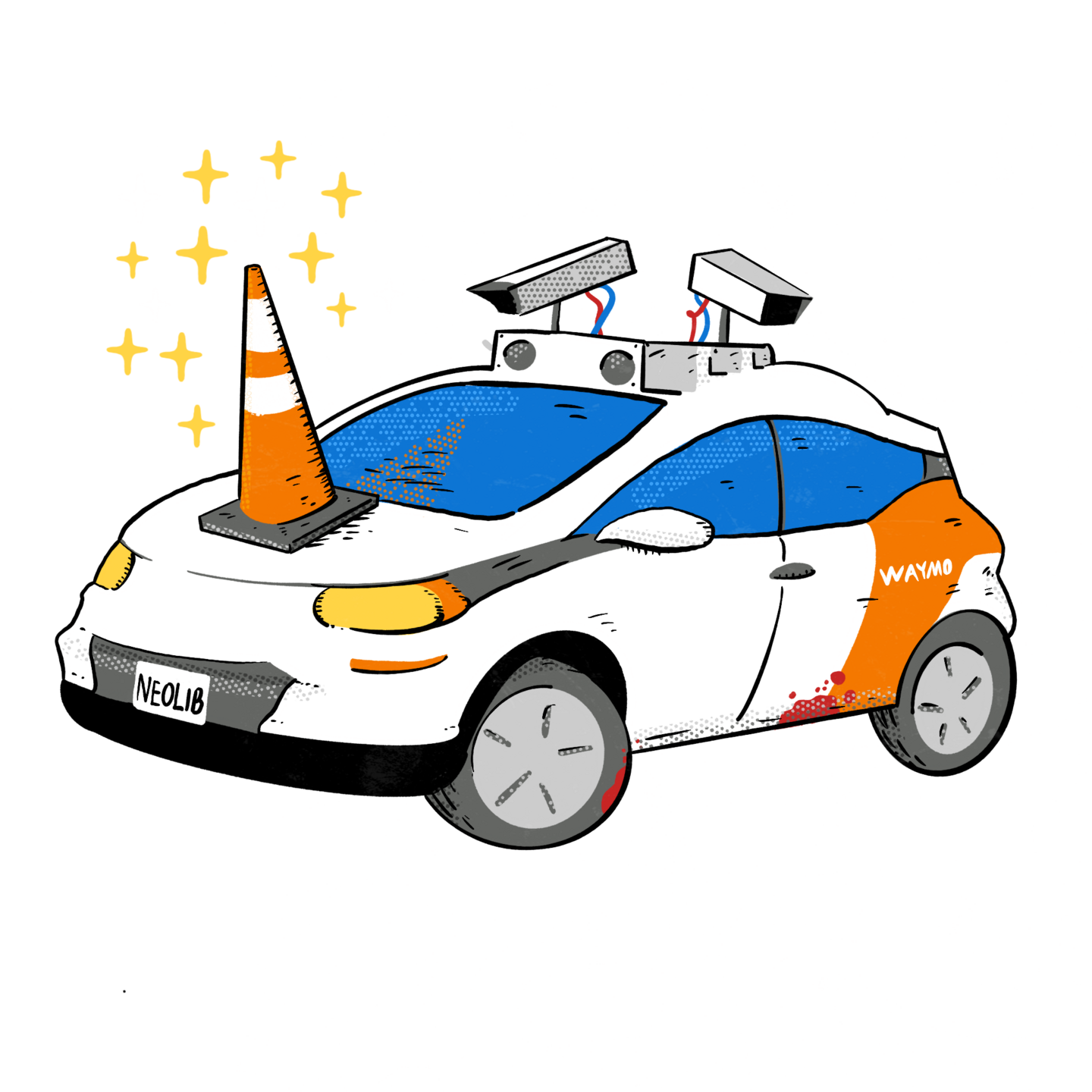

Driverless cars are expensive. No one is making money yet, not even Waymo, with all the might and resources of Alphabet at its back. GM has had its share of headwinds, but it stands a decent chance as any of proving whether the technology can be safe and profitable in the future.

See original article by Andrew J. Hawkins at The Verge