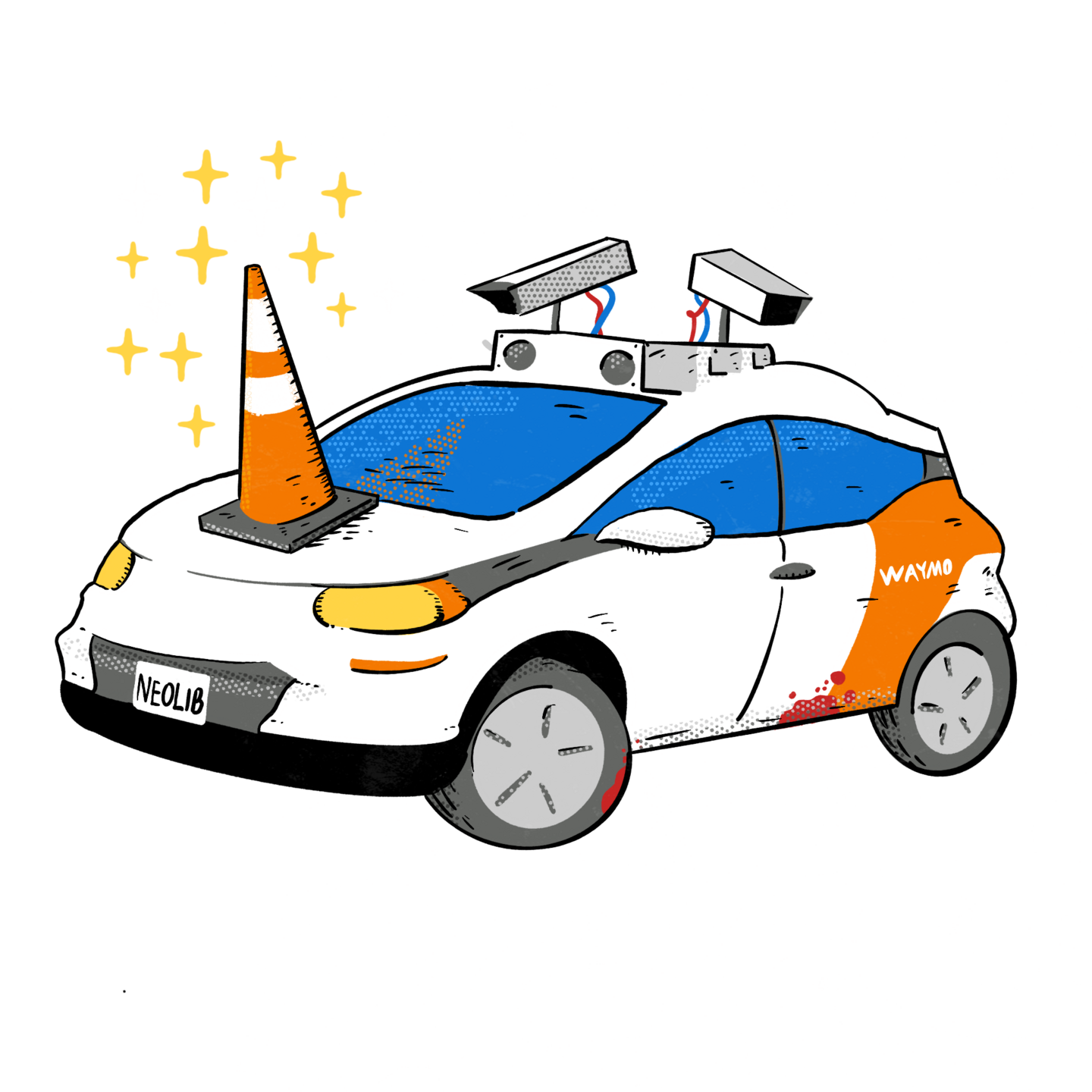

The Elon Musk “robotaxi reveal” aftermath. An epic disaster

Elon’s most expensive presentation ever

A picture is worth a thousand words, or maybe a million if those words are by Elon Musk.

After it became absolutely clear that Musk had absolutely nothing to deliver, Tesla stock took quite a beating. In fact, the market cap of the stock plummeted by:

$88.5B

Which is even higher than his outrageous and rescinded pay package of $56B.

But there is more. Investors realized that Uber and Lyft were under no threat from Tesla’s weak promises. Therefore their stock climbed impressively. It certainly would be interesting to know how much money flowed directly from Tesla to Uber and Lyft.

Public Transportation is icky!

In perhaps Elon’s most pathetic claim, he states that transportation sucks and shows the slide below.

- “COSTS TOO MUCH”

- “NOT SAFE”

- “NOT SUSTAINABLE”

Yet what Elon was actually showing was a real working transportation system that is heavily used, electrically powered, lithium free, incredibly safe, and of course as sustainable as one can possibly get. Dude, I know you are scared of the public, but even your lies are no match for the effectiveness of public transportation. That is why so many people use it, as evidenced by the picture.

It isn’t a lie if there is a disclaimer

Those who have been following Elon Musk over the years know that he just cannot not lie.

- Musk in 2019: “Next year for sure we will have over a million robotaxis on the road.”

- Musk in 2020: “I think we could see robotaxis in operation … next year. Not in all markets, but in some.”

- In 2021: “I’m highly confident the car will drive itself for the reliability in excess of a human this year.”

- In 2022: I would be shocked if we do not achieve full self-driving safer-than-human this year.”

- 2023: “Now, I know I’m the boy who cried [Full-Self-Driving], but man, I think — I think we’ll be better than human by the end of this year.”

- And this summer: “Obviously, my predictions on this have been overly optimistic in the past. … Next year seems highly probable to me.”

So the lawyers at Tesla, tired of being sued by shareholders, put up this impressive disclaimer at the beginning of the reveal event live stream, in a font too small and too faint for most to read:

But hey, turns out you can easily OCR a screenshot of the disclaimer and get readable text:

Certain statements in this presentation, including, but not limited to, statements relating to the development, strategy, ramp, production and capacity, demand and market growth, cost, pricing and profitability, investment, deliveries, deployment, availability and other features and improvements and timing of existing and future Tesla products and services; statements regarding operating margin, operating profits, spending and liquidity; and statements regarding expansion, improvements and/or ramp and related timing at our factories are “forward-looking statements* within the meaning of the Private Securities Litigation Reform of 1995. Forward-looking statements are based on assumptions with respect to the future, are based on management’s current expectations, involve certain risks and uncertainties, and are not guarantees. Future results may differ materially from those expressed in any forward-looking statement. The following important factors, without limitation, could cause actual results to differ materially from those in the forward-looking statements: the risk of delays in launching and/or manufacturing our products, services, and features cost-effectively; our ability to build and/or grow our products and services, sales, delivery, installation, servicing and charging capabilities and effectively manage this growth; consumers’ demand for products and services based on artificial intelligence, robotics and automation, electric vehicles, and ride-hailing services generally and our vehicles and services specifically, as well as our ability to successfully and timely develop, introduce, and scale such products and services; the ability of suppliers to deliver components according to schedules, prices, quality and volumes acceptable to us, and our ability to manage such components effectively; any issues with lithium-ion cells or other components manufactured at our factories; our ability to ramp our factories in accordance with our plans; our ability to procure supply of battery cells, including through our own manufacturing: risks relating to international expansion; any failures by Tesla products to perform as expected or if product recalls occur; the risk of product liability claims; competition in the automotive, transportation, and energy product and services markets; our ability to maintain public credibility and confidence in our long-term business prospects; our ability to manage risks relating to our various product financing programs; the status of government and economic incentives for electric vehicles and energy products; our ability to attract, hire and retain key employees and qualified personnel; our ability to maintain the security of our information and production and product systems; our compliance with various regulations and laws applicable to our operations and products, which may evolve from time to time; risks relating to our indebtedness and financing strategies; and adverse foreign exchange movements. More information on potential factors that could affect our financial results is included from time to time in our Securities and Exchange Commission filings and reports, including the risks identified under the section captioned “Risk Factors” in our annual report on Form 10-K filed with the SEC on January 26, 2024 and subsequent quarterly reports on Form 10-0. Tesla disclaims any obligation to update information contained in these forward-looking statements whether as a result of new information, future events or otherwise.

From the Tesla robotaxi reveal live stream

My favorite part is:

our ability to maintain public credibility and confidence in our long-term business prospects;

given that as of today they have completely lost public credibility.

See for yourself

The following is the full live stream, including 50 minutes of silly animation due to the event starting so late.

For those who don’t want to wade through the entire livestream, here is an 8 minute condensed version:

But let’s hear from the analysts

This screenshot says it all. Musk provided no real content. And of course it was also clear that Tesla is not developing a lower-cost vehicle.

But watch the whole video:

And Barron’s had a couple of short but good articles, including:

Barron’s 5 Reasons Tesla Stock Is Falling. (Elon Musk Is One.)

Tesla stock was falling sharply Friday after the company’s highly anticipated robotaxi failed to meet investors’ lofty expectations.

Shares were at $218.01, down 8.7%, shortly after the market opened for trading.

It’s a steep drop. There are a few reasons for the decline. The biggest reason might just be CEO Elon Musk.

From time to time, investors worry that Musk is doing too much to the detriment of his electric-vehicle company. He runs Tesla, X, SpaceX, xAI, and a few other companies. Musk has also indicated he’d consider taking a position in a second Trump Administration. Tesla events are a chance for investors to see Musk talk about his car company and gauge his level of engagement.

But late Thursday Musk only talked for about 20 minutes and most of what he said he had said before. Investors wanted more.

The overall lack of detail is another reason investors were disappointed. Tesla did reveal a physical Cybercab and said it plans to start robotaxi service in 2025. They are both positives. But there wasn’t much detail about how to achieve regulatory approval or what level of safety Tesla’s most current robotaxi software and hardware has been able to achieve. Tesla didn’t check all the boxes.

Tesla did offer investors some surprises though. There were plenty of robots and Tesla also unveiled a Robo-Van that can be a commercial vehicle or a mini self-driving bus. But there was no lower-priced Tesla model that investors typically refer to as the Model 2. Tesla still needs to sell more cars and another model would help. Tesla is slated to start selling the vehicle in 2025. It would have been nice to see one.

Wall Street isn’t helping things either. Almost 60 analysts cover Tesla stock, according to FactSet. They all have opinions following the event. Most analysts expressed some level of disappointment, wanting more details about everything.

Some analysts, such as Wedbush’s Dan Ives and BofA’s John Murphy had some positive things to say, but those views were in the minority. The majority of views sounded a little like what Piper Sandler analyst Alexander Potter wrote. Investors wanted “something more concrete.”

Tesla shares, of course, also were falling because they have been rising recently. Tesla stock typically rises into an event and falls after. Coming into Friday, Tesla stock had risen about 45% since Musk tweeted on April 5 that Robotaxi Day was coming It also rose about 6% over the past month.

and

Barron’s Why Tesla’s Biggest Bull Is Unimpressed

One of Tesla stock’s biggest bulls is unimpressed.

“That’s it?” asked Morgan Stanley analyst Adam Jonas in a Friday report.

He continued: The “highly anticipated ‘We, Robot’ event demonstrated Cybercab (expected) but overall disappointed expectations on a number of areas: a lack of data regarding rate-of-change on [self driving] tech, ride-share economics and go-to-market strategy.”

Jonas is a Tesla bull. He has a Buy rating on the stock and $310 price target for Tesla shares. That’s the highest target price listed on FactSet and values Tesla at roughly $1 trillion.

About 80% of Jonas’ target price comes from businesses that are not directly related to assembling cars. “Network Services” and “Mobility” businesses—things related to self-driving software and robotaxis—make up $158 of his $310 price target.

Jonas expected Tesla stock to be under pressure following the event. So far, he’s right.

Tesla stock opened at about $220 a share and traded as low as $214.38. Shares were at $222.08, down 7%, in midmorning trading.

But what about the incredible robots???

Um, Josh Sawyer is 100% correct. That was another fake Elon demo done by teleoperation. Robots are autonomous, not teleoperated.

And of course there was Gizmodo article from May 2024 titled Robot Makers Try to Reassure Public They’re Legit After Elon Musk Fudged Demo

But at least a step up from the demo three years ago

Propagandist