Barron’s – Alphabet’s Waymo Raises More Money to Compete With Tesla Robotaxis

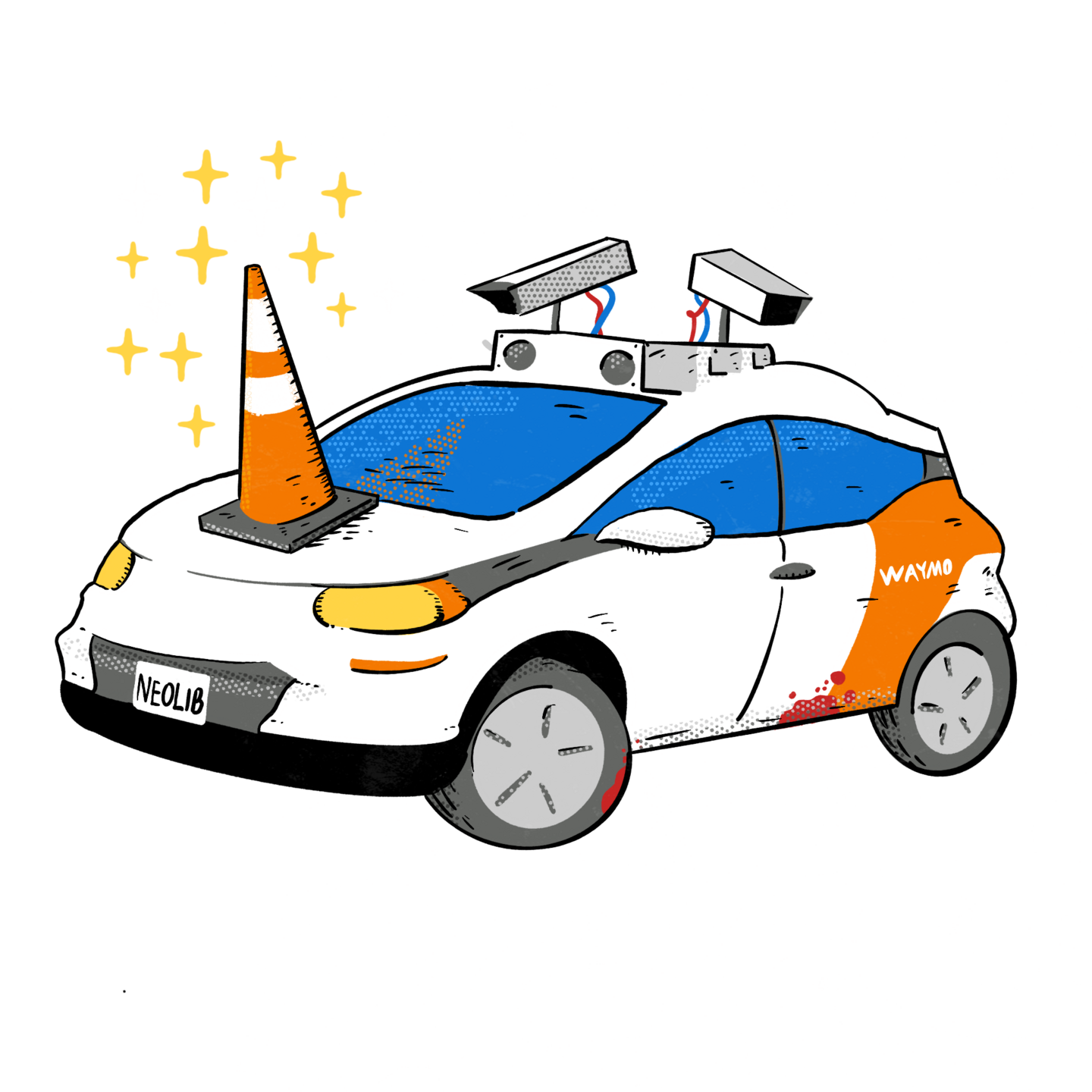

Editors note: This is it folks, the hype peak of robotaxis. Tesla does a completely fake demo and then Waymo raises another $5.6 billion to burn!

See original article by Al Root at Barron’s

The driverless-taxi company said it had raised $5.6 billion, its largest capital raising to date.

Robotaxi fever is rising. Tesla deserves some credit for that, but investors shouldn’t forget Alphabet’s Waymo, which is expanding rapidly.

Friday, Waymo said it had raised $5.6 billion via what it called an “oversubscribed investment round,” collecting funds “from Andreessen Horowitz, Fidelity, Perry Creek, Silver Lake, Tiger Global, and T. Rowe Price.” It was Waymo’s largest capital raising to date.

Waymo is private, but it still sells shares. “Oversubscribed” simply means there was more demand for shares than Waymo sold.

Alphabet controls Waymo, which declined to comment about what percentage Alphabet owns or what its new valuation was following the capital raise.

Waymo has been valued at about $50 billion in the past, based on private-market transactions. Uber Technologies, which partners with Waymo, has a market value of about $165 billion.

Uber and Waymo plan to launch self-driving cab service—available through the Uber app—in Atlanta and Austin, Texas, in early 2025. That would amount to more growth for the robo-taxi company, which is already completing more than 100,000 self-driving taxi rides a week.

Tesla’s valuation dwarfs those figures. Its market capitalization is about $800 billion, but it is still mainly a car company. Exactly how much of that is robo-taxi potential is hard to say.

Barron’s wrote recently that it is possible to justify a $200-per-share valuation for the company’s car and energy-storage business. Anything above that could be attributed to other ventures such as robo-taxis. By that logic, Tesla’s robo-taxi business is worth some $180 billion.

That is a very rough calculation. Tesla stock jumped 22% on Thursday after the company reported better-than-expected third-quarter earnings. The car business deserves much of the credit for the rise, but management also talked more about their plans to launch a robo-taxi service in California and Texas in 2025. CEO Elon Musk sees Tesla’s driver assistance features becoming better than human drivers in the first half of 2025.

That is a big difference between Waymo and Tesla. The former already has data showing a 75% reduction in injury-causing accidents relative to humans with no drivers intervening in Waymo vehicles. It didn’t, and couldn’t launch, service until Waymo’s self-driving system was doing better than humans. Tesla is refining its existing driver-assistance product to the point that it is better than humans while Tesla drivers oversee the system while traveling around in their cars.

One thing investors should note about the size of the capital raising is that developing self-driving cars isn’t cheap. Tesla reported $3.5 billion in capital spending for the third quarter, up about $1 billion year over year. Part of the money went to increasing “AI compute by 75%,” according to the company’s earnings release.

Tesla uses artificial-intelligence systems to train its self-driving cars and the humanoid robots it hopes to sell in the coming years.

Tesla stock rose 3.3% on Friday, closing at $269.19. Alphabet stock added 1.6% to $165.27. The S&P 500 closed down slightly and

Dow Jones Industrial Average fell 0.6%.

See original article by Al Root at Barron’s