Forbes – Want To Hail An Autonomous Vehicle? Pay More To Get There Slower

Editors note: Safety is not going to be the issue that kills Waymo. It is going to be that they provide an inferior service, since it is slower and more expensive than taking an Uber or Lyft. Once the novelty of going on a Disneyland Tomorrow World (aka “Yesterday Land”) ride wears off, there won’t be enough demand to ever make a profit. Yes,

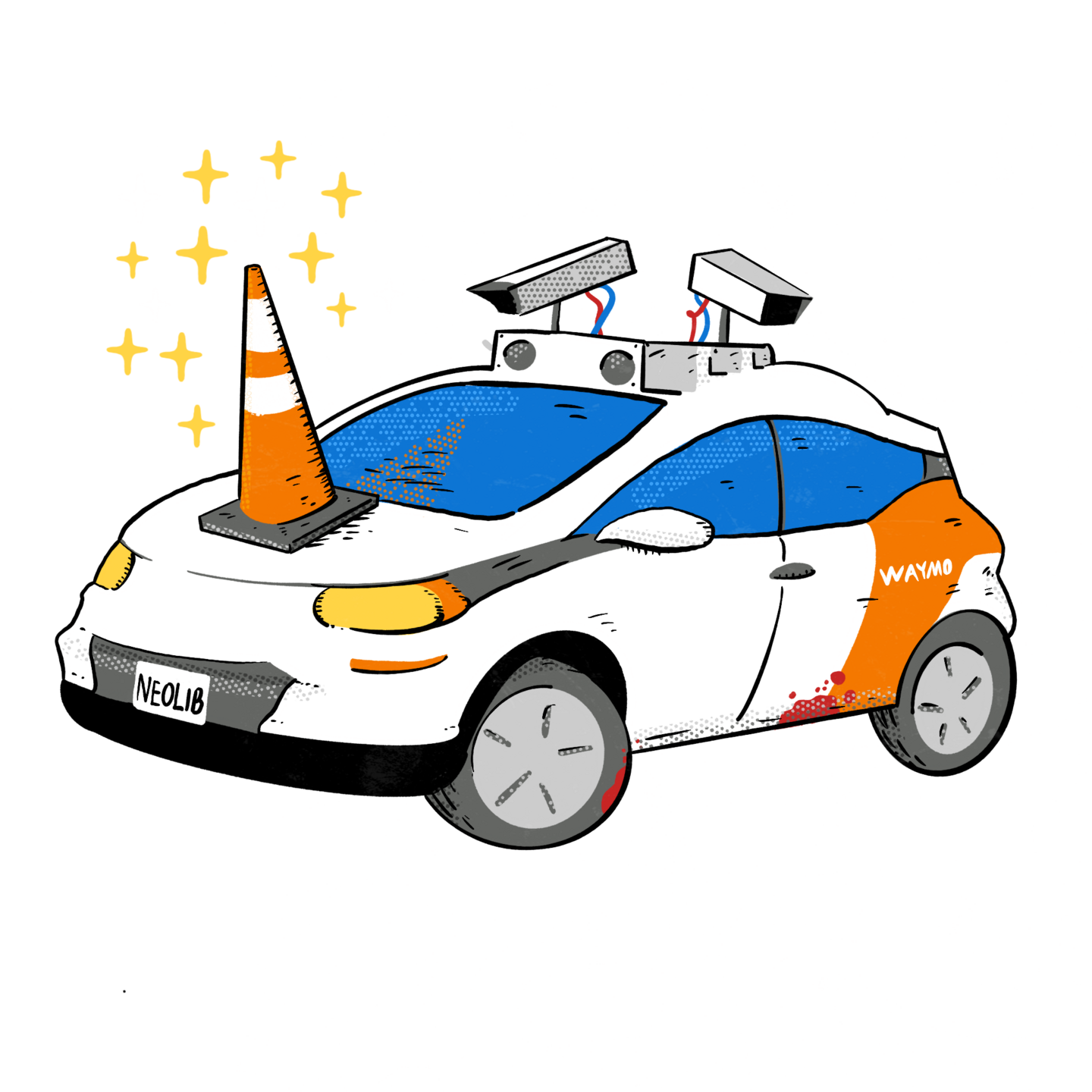

Waymo, the Juicero of transportation!

See original article by Gustavo Castillo at Forbes

A price comparison between Waymo and rideshare services, shows Waymo is more expensive and takes over twice as long to arrive

Waymo just filled their coffers in a fresh round of funding, closing a Series C round of $5.6 billion. The company plans to use these funds to continue developing their technology and expanding their service. In the autonomous vehicle world, Waymo is far and away the leading player with commercial deployments in multiple markets completing 150,000 rides and 1 million driverless miles each week. These numbers are impressive and are certain to grow as they expand their service to new cities. How difficult will it be for the company to convince the mass market to use Waymo as their go to rideshare company?

The JD Power 2023 US Mobility Confidence Index Study found only 37% of consumers reported being comfortable riding in a fully automated self-driving vehicle. The same survey also found that trust has been declining in the past two years from a comfort level of 42% in 2021 likely driven by bad press.

If San Francisco serves as an example, one need not look far to find examples of people exhibiting their disdain with AVs. In 2023, San Francisco residents used orange traffic cones and placed them on the hoods of autonomous vehicles to immobilize them. The movement made its rounds on social media further fueling the metaphorical flame; but there have also been instances of literal flames too. In 2024, a Waymo vehicle in San Francisco drove through Chinatown during Chinese New Year. The crowd greeted the vehicle with less than open arms and one individual shot a firework into the car causing the vehicle to catch fire.

Comparatively, rideshare has been so deeply ingrained in consumers’ minds, it would be difficult to imagine a world without it. A Pew Research study in 2019 found that 71% of adults making more than $75k/year living in an urban area had used a rideshare service. It would be difficult to find someone with an aversion to using Uber or Lyft. As Waymo expands they will need to convince the 35% of consumers who are willing to ride an AV to make the switch from rideshare to their platform.

When AV companies were in the peak of their hype cycle, many praised their ability to greatly reduce the cost of transportation for all. Can AV companies win over consumers by offering a better or more affordable service than rideshare? I ran a comparison of 50 rides in Los Angeles between Waymo, UberX, and Lyft measuring the service with three different metrics:

- Price at Booking

- Quoted Time to Pickup (TTP) before booking

- Estimated Time of Arrival (ETA) before booking

The sample included variations of pick up and drop off points across the city at morning, afternoon, and evenings times. In the 50 ride sample, the average rideshare price was $28.14 and the respective Waymo ride was $9.50 more. The price differential would be less stark if a consumer is accustomed to tipping 20% at the end of their rideshare trip. Waymo’s quoted TTP was more than twice as long as the average rideshare service.

Currently Waymo does not operate on freeways and their vehicles drive more conservatively than human drivers. The combinations of these factors meant ETA was 121% longer than rideshare. In one instance, a ride from Santa Monica to Downtown would have taken 29 minutes on rideshare but 1:18 hours with Waymo. A final factor observed in a couple rides, was that Waymo could not drop off a passenger exactly where they requested, and required an additional short walk to their destination. Overall, more data is needed to understand exactly how Waymo compares to ride share across markets; but, this study directionally points to the higher costs and slower service AVs provide today.

The current status of AVs means that cost and time sensitive customers still choose rideshare. For the time being, AVs will not be the low cost solution to transportation companies initially promised. As Waymo expands with a driverless fleet of Jaguars, there is indication they are positioning themselves as a premium experience; but even a customer willing to pay more may be put off by the slower service and in some cases it would have been comparable to take a premium product offering from a rideshare company. Finally, Waymo can only operate within a specified geofence and will only be able to serve a subsegment of rides for customers that are willing to pay the higher price and have the patience to wait longer to arrive at their destination.

In the meantime, Waymo will primarily see demand from customers that take rides for the experience. But a cool experience will not ensure sustained demand at scale.

See original article by Gustavo Castillo at Forbes